A Risky Plan: Connecticut’s Public Option Proposal

Connecticut’s Partnership Plan 2.0, the basis for the public

option, is a health plan run by the state comptroller that

piggybacks on the state employee health plan network

to provide comparable benefits to local government

employees. But premium and claims data show it has

operated at a significant loss, engaged in predatory pricing

to capture market share, and used premiums from new

enrollees to conceal red ink. Had such unsavory tactics

been attempted by a private insurer, the state Insurance

Department likely would have shut down the plan

years ago.

What is a public option?

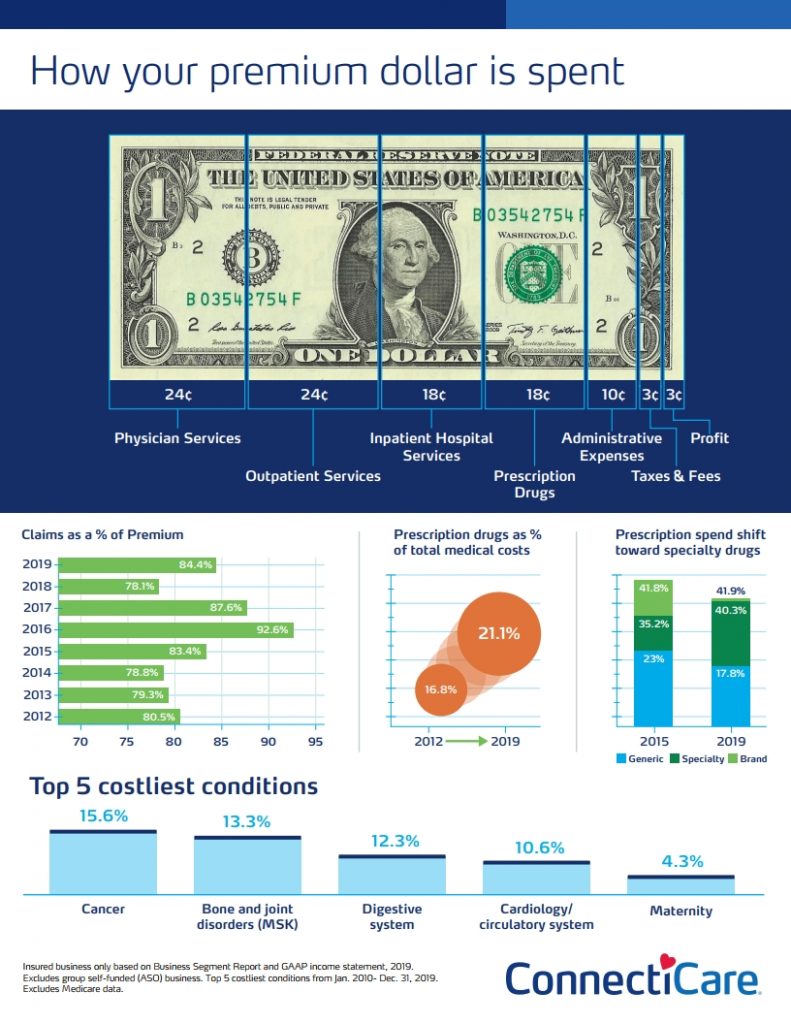

At its core, a public option proposal aims to enroll businesses and individuals for health care coverage under a new state government-run program. Like Medicaid and Medicare, it is premised on a reduced provider fee schedule that, if passed, will destabilize the current health care system, require a cost shift to private purchasers of health care, and/or result in increased taxes and fees.

Imagine that the state offered every resident a mid-sized Ford sedan for $100 a month. The price of the Ford subsidized by 1) a reduced charge from Ford in return for volume and 2) a surcharge (cost-shift) on other dealerships like Chevy, Buick, and Dodge. Fast forward, and it is only a matter of time before the other dealerships listed are priced out of the market because they can’t compete with a $100 Ford. In response, the subsidized cost of the Ford skyrockets to $1,000 a month and consumers are left with no other choice but to pay the huge new price tag because the rest of the market has evaporated. That is public option in a nutshell.

Health insurance carriers welcome competition if the rules are the same for everyone. Despite rhetoric to the contrary, the private market has responded to the need for affordably priced products structured around innovative, value-based benefit designs. There are fixed costs, however, like taxes and assessments levied on fully insured policies that inflate the cost of premiums — costs the Comptroller doesn’t have to pay on his Partnership Plan.

What can be done to lower insurance premiums?

Premiums are a reflection of underlying health care costs. Coalition members agree with the need to reduce the cost of health care services and therefore the cost of health care coverage, but such measures need to be undertaken in a deliberate and thoughtful manner.

First – do no harm. Connecticut policymakers must refrain from adopting new mandates and policies that add to the bottom line of health care costs and therefore health care coverage premiums.

Member carriers are in discussions with the Office of Health Care Strategy on implementation of Executive Order #5 establishing a new health care cost benchmark growth target. The benchmark process has been proposed to ensure access to quality, affordable, health care coverage that builds upon the strong foundation of the Affordable Care Act without undermining its underpinnings.

- One straight-forward way to reduce premiums is an across the board repeal of the 1.5% premium tax and associated assessments levied on fully-insured policies. This revenue will be lost anyway if a government-run public option is passed. The Comptroller is not subject to taxes.

- Fix the current emergency room surprise billing statute so that providers aren’t financially incented to be out of network.

- Maximize federal reimbursement policies. Consider the opportunities afforded by 1332 waivers to establish reinsurance programs or other relief to those most in need, but be wary of adopting funding mechanisms that tax premiums as a way to redistribute financial relief.

Background

- Brown & Brown 21-22 Municipal Trend

- Brown & Brown 20-21 Municipal Trend

- State Partnership Plan losing money but still more expensive than average CT plan options: Ellen Andrews, Connecticut Health Policy Plan, 2.23.21

- Municipal Members of The State Partnership Plan

- Survey: State-Run Healthcare Plan Sparks Small Business Concerns: Wyatt Bosworth, CBIA, 2.2.2021

- Medicaid Expansion Debate: Mary Fitzpatrick, Office of Legislative Research, 2.2.2021

- Lawmakers Push Health Insurance Premium Tax: Wyatt Bosworth, CBIA, 1.26.2021

- Public Act 19-117 Implementer With Partnership Language

- U.S. Department of Labor Advisory Opinion to Governor Malloy on Adverse Impact of Opening up the Partnership Plan. 9. 27.2012

- Wakely Report: Individual Market Stabilization/Reinsurance Analysis. March 23, 2019

- Connecticut Can’t Afford a Public Insurance Plan: Greg Bordonaro, Hartford Business Journal, 11.30.2020

- Beware New Proposals for State-Funded Health Insurance: Kevin Rennie, Hartford Courant 11.20.2020

- Better Options than a ‘public option’ for Health Care. Kevin Kelly, newstimes, 11.22.20

- Access Health CT (Exchange Board Operations & Budget Update) 11.19.20

- State-Run Healthcare: CBIA Issues & Policies 11.12.20

- Rand Study 2020: Nationwide Evaluation of Health Care Prices Paid by Private Health Plans

- Why is Healthcare so Expensive: CBIA Issues & Policies 02.20.20

- Solving America’s High Drug Cost Problem: Prevent Drug Company Tactics that Increase Costs and Undermine Clinical Quality PCMA

- The Fiscal Effects Of The Public Option: Tom Church, Daniel L. Heil And Lanhee J. Chen, Ph.D. with Support from The Partnership For America’s Health Care Future

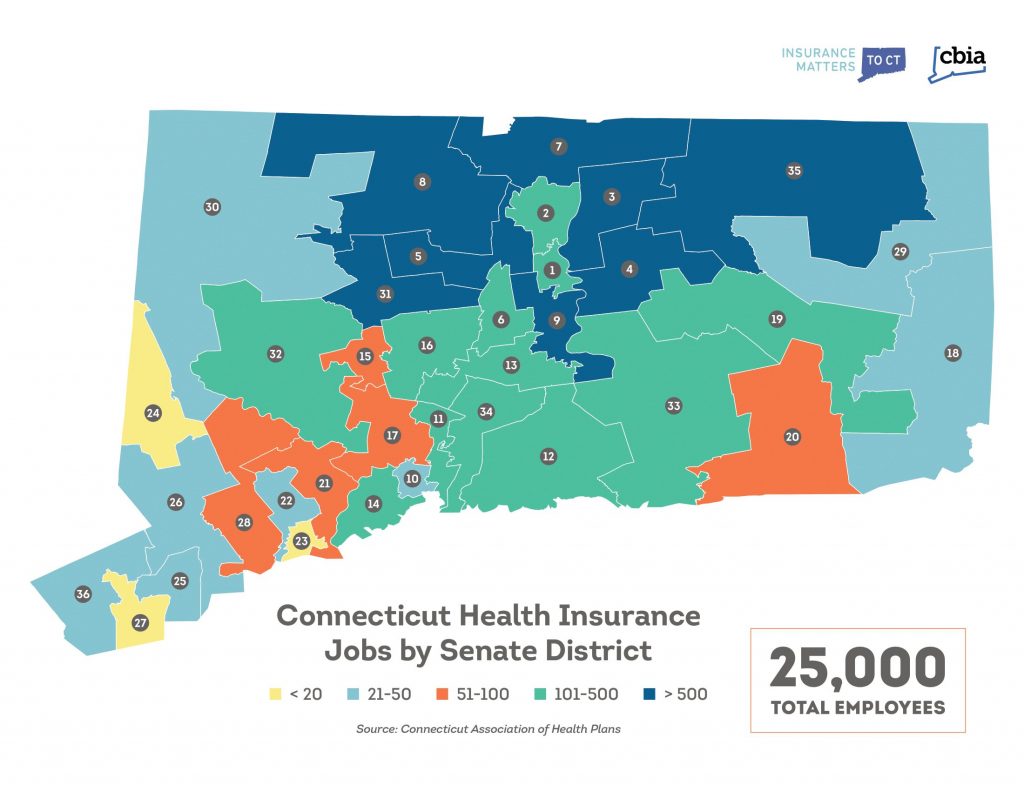

- Connecticut Economic Resource Center (CERC) Impact of Health Insurance Industry on the State of Connecticut 03.19

- Health Insurance Industry’s Major Impact on State’s Economy: CBIA Economy 05.22.19

- State-Run Healthcare’s Uneven Playing Field: CBIA Issues & Policies 05.08.19

- Kentucky’s Lesson for Connecticut on State-Run Healthcare: CBIA Issues & Policies 04.23.19

- Kentucky Syndrome: Stephen Spruiell, National Review, 4.15.2010

- Fiscal Analysis of the impact of the provisions on the State Plan: U.S. Department of Labor, 4.27.2012

- Town Leaders Look to Hartford For CMERS Help: “bad news from State Comptroller Kevin Lembo last week. The towns’ contributions to the Connecticut Municipal Employee Retirement System will increase between 2 and 2.5 percent this year and up to 10 percent over the next five years. Denise Coffey, Hartford Courant 03.11.19

- 2018 Connecticut Insurance Market Brief: Connecticut IFS/PwC

- OLR Issue Brief: Connecticut Health Insurance Reform Proposals 2020-R-0271

- Health Reinsurance Association and the Connecticut Small Employer Health Reinsurance Pool: Janet Kaminski, OLR, 1.28.2021

- OLR Issue Brief: Importing Prescription Drugs 2018-R-0170

Learn why other stakeholders oppose state-run public option bills.

- Opposition Testimony: CT Teamsters

- Opposition Testimony: CT Benefit Brokers

- Opposition Testimony: AHIP

- Opposition Testimony: CBIA

- Opposition Testimony: Harvard Pilgrim Health Care

- Opposition Testimony: ConnectiCare

- Opposition Testimony: Cigna

- Opposition Testimony: Aetna

- Opposition Testimony: Anthem BlueCross BlueShield

- Opposition Testimony: Health Benefits Institute

- Opposition Testimony: Connecticut Association of Health Plans

- Opposition Testimony: J.P. Weiske, former WI Deputy Insurance Commissioner

- Opposition Testimony: American Association of Health Insurance Plans

- Opposition Testimony: Connecticut Hospital Association

- Opposition Testimony: Connecticut Business and Industry Association

- Opposition Testimony: Connecticut Benefit Brokers

- Opposition Testimony: Rogers Benefit Group